We would like to present to you three gold mining shares, which will increase disproportionately if gold prices continue to rise. All three stocks are managed by top mining CEOs and have an impressive shareholder structure.

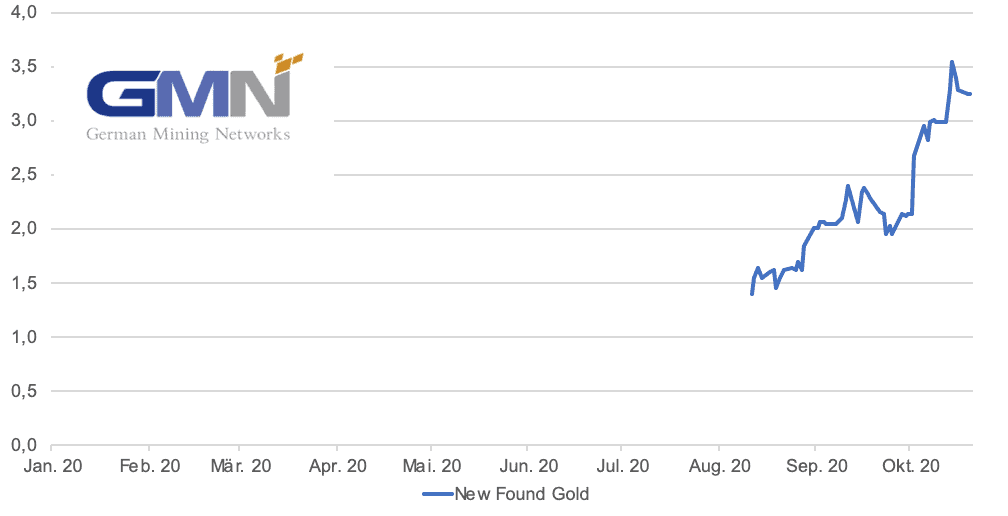

New Found Gold

Eastern Canada’s newest gold exploration play with a major drill program of 100,00m ongoing. Prominent shareholders include Rob McEwen and Eric Sprott. Advisor Quinton Hennigh considers the geology similar to the high-grade Swan Zone at Kirkland Lake’s Fosterville mine in Australia, one of the highest-grade and lowest-cost producers globally. Newfound is well-funded with 75 Mio in the bank.

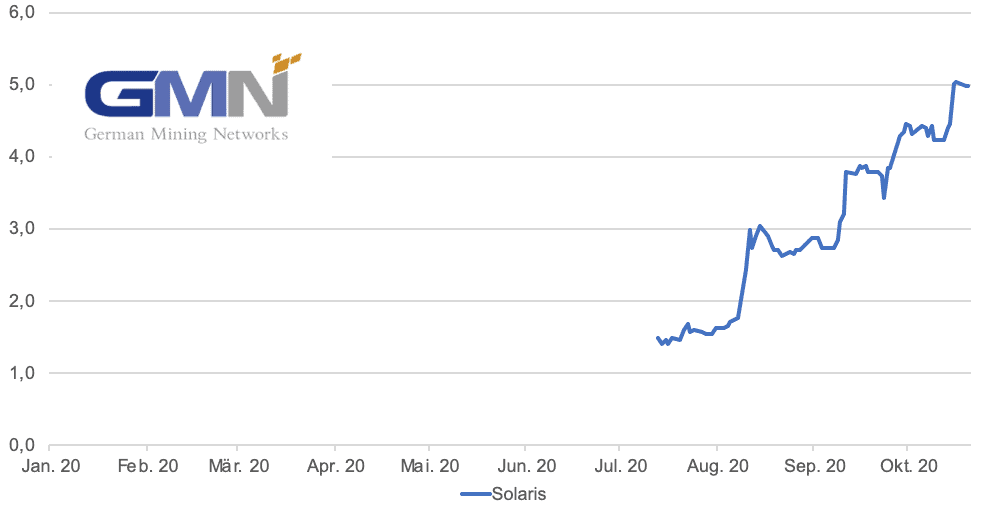

Solaris Resources

David Lowell’s and the Augusta Group’s newest exploration play in South America with blue sky potential. The shareholders involved (Ross Beaty, Lundin family, Richard Warke) speak for themselves and are a guarantee for future success. Great play for anyone interested in a copper-gold discovery.

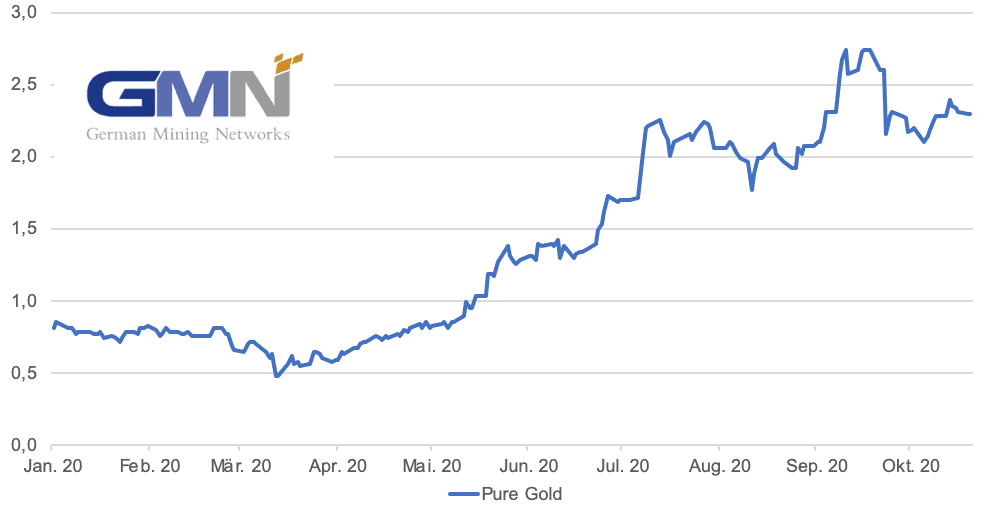

Pure Gold Mining

Red Lake’s next gold producer with Rob McEwen and Eric Sprott as major shareholders. Current market cap sits at 900 Mio and a production target of 80koz/annum with all in costs of $800/oz. Lots of upside potential with increase in mining grade and discovery of new high grades zones. Newmont’s Red Lake mine is just 10 kilometers away and produced 25 million ounces of gold. Another Kirkland Lake?

GMN Private Placement List

If you would like to participate in the next Private Placement together with us and our investors, please sign up for our Private Placement list via this (link).