Mining shares can be acquired both on the stock exchange and through private placements.

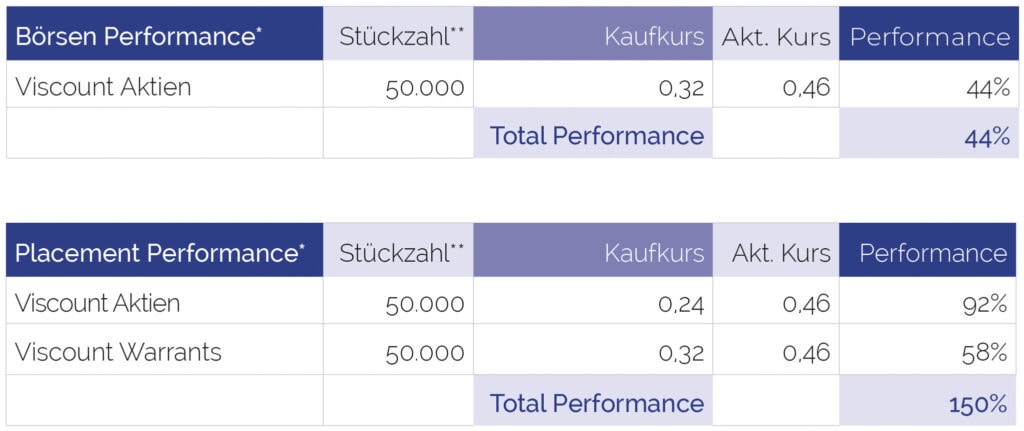

In the following, we have calculated the performance advantages that arise from participating in private placements. The example is Viscount Mining, an undervalued Silver Junior, where we recently participated in the placement at 24cts, while the share itself was already trading at 0.32cts.

As you can see in Table 1, if you had bought Viscount on the stock market, you would have earned only 44%. Due to a more favorable entry in the private placement (24cts vs. 32cts via the stock exchange), the performance is already 92% with the share and 58% with the warrants. Warrants have the characteristic to profit free of charge on further price increases of the share as of a certain mark.

In the case of Viscount, this mark is 32cts; each additional 1ct increase means here (1ct x 50,000 warrants) = 500 CAD additional profit that you do not have when buying the shares on the stock exchange. This represents an unbeatable performance advantage that only private placements can offer.

Take-Away

- Private placements enable you to buy shares at a lower price than on the market

- Profit twice as much from rising prices through warrants

- Invest on the same terms as company founders, institutional investors and hedge funds

- Secure the best return on your equity

For the reasons mentioned above, we invest exclusively through private placements. Do it now and sign up for our Private Placement Newsletter to receive an allocation in the next Private Placement.

GMN Private Placements

If you would like to participate in the next private placement together with us and our investors, please sign up for our private placement list via this link.