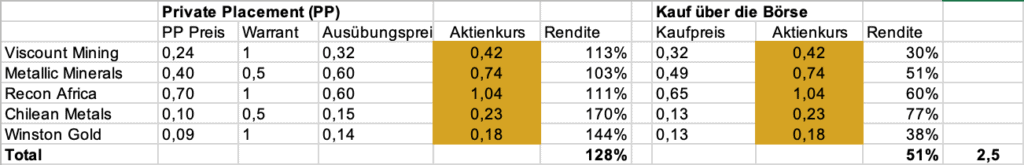

As we already showed in (Why you should only invest through Private Placements (PP)), the performance advantages of PPs are obvious. In gold bull markets like the current one, you can achieve such significant performance differences which even surprise us. We therefore compared the performance of the 5 most popular private placements, in which a large number of the investors on our Private Placement list participated, with the conventional way of purchasing on the stock exchange.

Analysis: With an assumed investment of €50,000 the buyer only obtains €75,609 if purchased the conventional way via the stock exchange. When investing in the very same titles via private placements, the current assets amount to €114,087. This difference amounts to €38,478.

As an investor, you are now in the fortunate position to choose from 2 options. a) You remain invested in the current values. The difference will continue to increase and become more and more significant or b) you sell the shares, keep the warrants of the 5 values and invest in further private placements in order to buy shares again at a lower price than on the market and to receive further warrants.

The extreme example of Artemis Gold: Finally, let us turn to an “extreme value analysis”. The initial investors among our investors received Artemis Gold at the IPO for $0.90 including a full warrant at $1.08. The share is currently trading at $6.09, which represents a performance of 1,113% including warrants. The stock market performance is only 509%. The €10,000 becomes €60,900 or by participating in the placement €121,300. Your choice!

GMN Private Placement List

If you would like to participate in the next Private Placement together with us and our investors, please sign up for our Private Placement list via this (link).